The global oil and gas industry in 2026 is not declining — it is transforming.

After years of volatility, regulatory pressure, environmental scrutiny, and rapid technological innovation, energy companies are redefining their business models. Rather than operating purely as hydrocarbon producers, many are evolving into integrated energy corporations balancing fossil fuel production with digital transformation and low-carbon investments.

Despite the rise of renewables, oil and gas continue to power transportation, manufacturing, petrochemicals, aviation, heavy industry, and global trade. However, the way energy is discovered, extracted, financed, and delivered is undergoing deep structural change.

Below is an in-depth look at the key forces shaping the industry in 2026 and beyond.

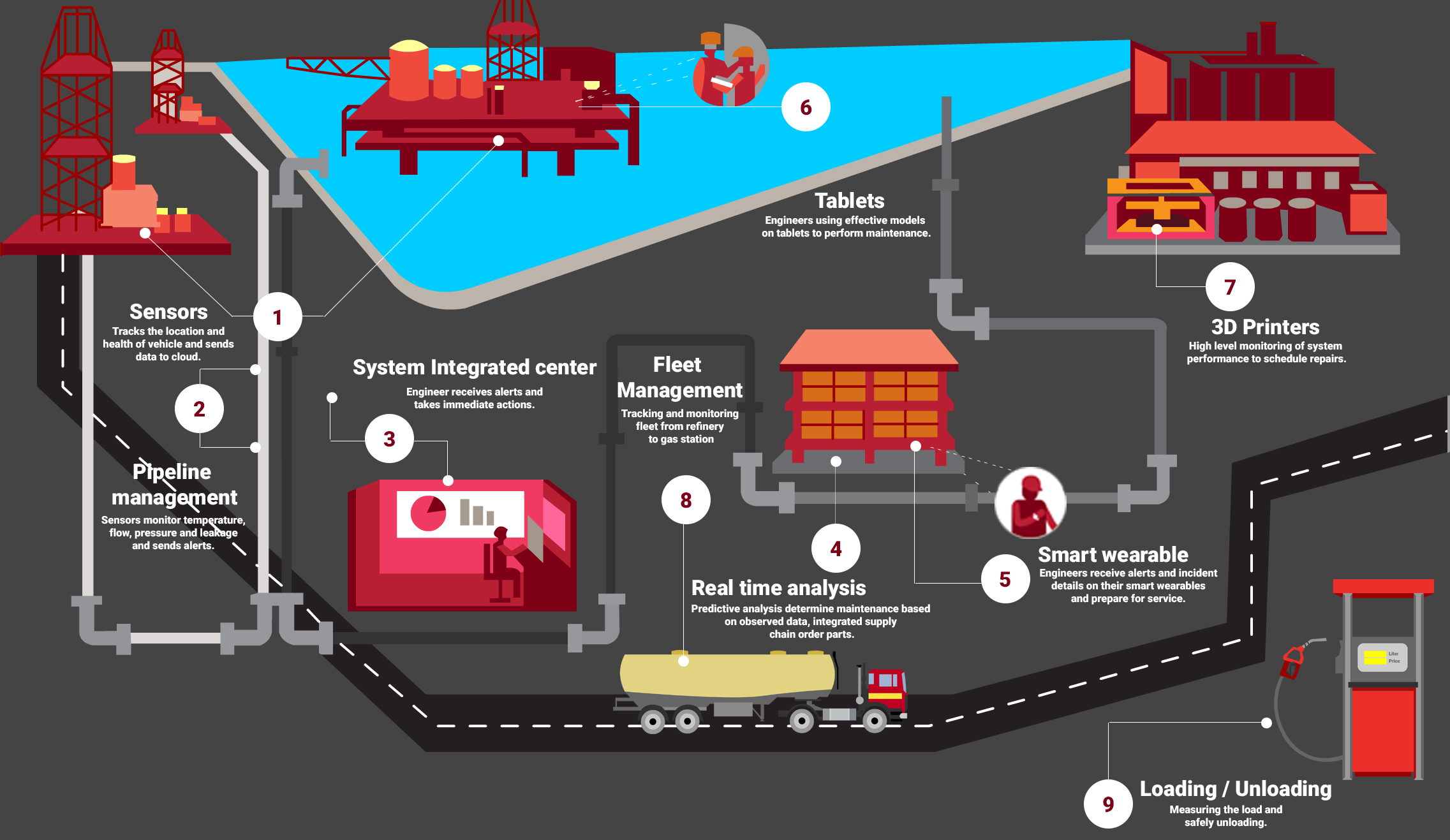

Digital Transformation & AI-Powered Oilfields

Digitalization is now central to profitability.

Oil and gas companies are increasingly adopting:

-

Artificial Intelligence (AI)

-

Machine Learning algorithms

-

Industrial Internet of Things (IIoT)

-

Digital twin simulations

-

Cloud-based operational dashboards

-

Robotic process automation (RPA)

AI-driven analytics now help operators:

-

Predict equipment failure before breakdown

-

Optimize drilling trajectories

-

Improve reservoir modeling

-

Reduce non-productive time (NPT)

-

Enhance worker safety through real-time alerts

According to industry outlook reports from the International Energy Agency, digital solutions can reduce upstream operating costs by up to 20% while improving recovery rates.

Digital twins — virtual models of oilfields or refineries — allow companies to simulate performance scenarios before implementing changes physically.

Impact:

The modern oilfield is becoming data-driven rather than labor-intensive.

Carbon Capture, Hydrogen & Decarbonization Investments

Energy companies are investing billions into:

-

Carbon Capture and Storage (CCS)

-

Blue hydrogen production

-

Methane leak detection technology

-

Electrification of offshore platforms

-

Renewable hybrid energy projects

Carbon Capture projects are expanding across North America, the Middle East, and Europe. Hydrogen — particularly blue hydrogen derived from natural gas with carbon capture — is gaining attention as a transitional fuel for heavy industries.

Investor pressure tied to ESG performance is influencing boardroom decisions. Major oil exporters coordinated under OPEC continue monitoring global supply-demand balance while members explore carbon-reduction strategies.

Rather than exiting fossil fuels immediately, companies are lowering operational emissions while maintaining production capacity.

Strategic Shift:

Oil majors are repositioning themselves as “energy solution providers,” not simply oil producers.

LNG Expansion & Natural Gas Dominance

Natural gas produces approximately 50–60% less CO₂ emissions than coal when used for electricity generation. As a result, many countries view LNG as a bridge fuel during the transition to renewables.

Key trends include:

-

Expansion of export terminals

-

Increased long-term LNG contracts

-

Infrastructure development in Asia

-

Floating LNG (FLNG) technology adoption

Europe and Asia continue increasing import capacity to ensure energy security.

LNG trade is becoming more flexible, with spot trading rising alongside traditional long-term agreements.

Market Outlook:

Global LNG capacity is projected to grow substantially through 2030, strengthening natural gas as a central pillar of energy transition.

Capital Discipline & Investor-Centric Strategy

After a decade of boom-and-bust cycles, oil and gas companies are prioritizing financial stability.

Key capital trends include:

-

Reduced debt exposure

-

Shareholder dividend protection

-

Focus on short-cycle, high-return assets

-

Divestment of non-core operations

-

Conservative expansion policies

Rather than aggressive exploration spending, companies are evaluating projects with strict break-even thresholds.

Institutional investors now demand:

-

Transparency

-

Stable returns

-

ESG compliance

-

Risk-adjusted project portfolios

Capital discipline is redefining how exploration and production budgets are structured.

Geopolitical Influence & Energy Security

Energy markets remain deeply tied to global politics.

Recent geopolitical realignments have reshaped supply dynamics. Sanctions, regional conflicts, and trade policies influence crude pricing and supply stability.

The International Energy Agency frequently highlights how energy security concerns are driving new upstream investments in strategic regions.

Countries are diversifying suppliers to reduce dependence on single energy sources.

Energy security is now as important as sustainability.

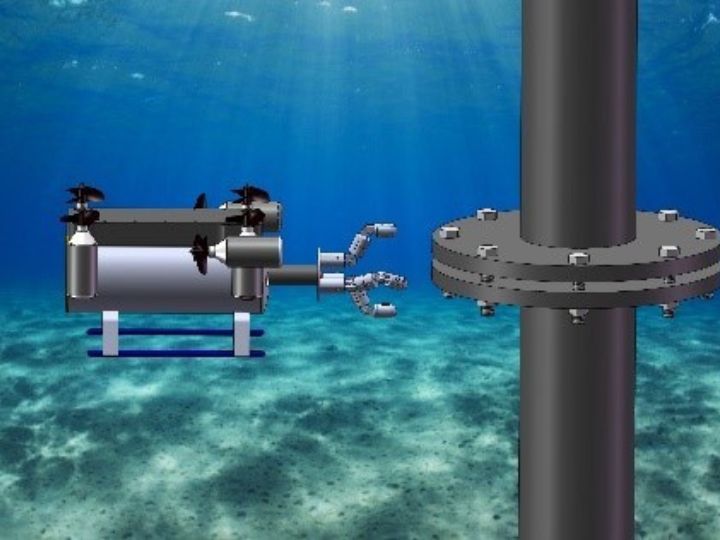

Automation, Robotics & Remote Operations

Automation reduces human exposure to hazardous environments.

Companies are deploying:

-

Inspection drones

-

Autonomous drilling systems

-

Robotic pipeline monitoring

-

Remote-controlled offshore platforms

Remote operations centers allow companies to manage multiple assets from centralized control hubs.

This reduces operating costs and improves safety metrics.

Cybersecurity as a Core Investment Priority

Digital oilfields increase vulnerability to cyber threats.

Energy infrastructure is considered critical national infrastructure, making it a high-value target for cyberattacks.

Companies are investing heavily in:

-

Industrial control system security

-

Cloud-based monitoring

-

AI-driven threat detection

-

Infrastructure encryption

Cyber resilience is no longer optional — it is essential to operational continuity.

Workforce Evolution & Digital Skill Integration

The oil and gas workforce is evolving.

New roles include:

-

Data analysts

-

AI engineers

-

Cybersecurity specialists

-

Automation technicians

-

Sustainability compliance officers

Traditional petroleum engineers are now integrating data analytics skills into their expertise.

The workforce model is shifting from manual-intensive to tech-enabled expertise.

Energy Price Volatility & Market Balancing

Oil prices remain sensitive to:

-

OPEC production adjustments

-

Global economic growth rates

-

Inflation

-

Currency fluctuations

-

Supply chain disruptions

Strategic reserves and diversified portfolios help mitigate risks.

While volatility remains, the industry is better prepared than in previous decades due to improved financial management and real-time market analytics.

Integration of Renewable Energy Assets

Oil and gas companies are increasingly investing in:

-

Offshore wind

-

Solar farms

-

Biofuels

-

Energy storage systems

Rather than competing with renewables, many firms are integrating them into diversified portfolios.

Hybrid energy systems are becoming common in offshore installations.

The Bigger Picture: Reinvention, Not Replacement

The narrative that oil and gas will disappear is overly simplistic.

Instead, the industry is:

✔ Digitizing operations

✔ Lowering emissions

✔ Expanding LNG

✔ Strengthening financial discipline

✔ Integrating renewables

✔ Enhancing cybersecurity

✔ Prioritizing energy security

Oil and gas will remain critical for petrochemicals, aviation fuel, heavy transport, and industrial manufacturing for decades.

The transformation underway is structural and strategic — not terminal.

Final Thoughts

The oil and gas industry in 2026 stands at a strategic intersection of innovation, sustainability, and global energy demand.

Companies that:

-

Embrace AI and automation

-

Invest in carbon reduction technologies

-

Maintain financial discipline

-

Strengthen cybersecurity

-

Adapt to geopolitical shifts

…will define the next era of global energy leadership.

The future of oil and gas is not about resisting change — it is about leading it.